How Inflation Affects Energy Prices

Right now, energy prices are rising rapidly and chaotically. At the same time, the country is talking seriously about inflation for the first time since the Carter Administration. Understanding inflation’s impact on the energy market requires suspending a lot of disbelief, because a lot of the factors are, for lack of a better word, made up and/or very weird.

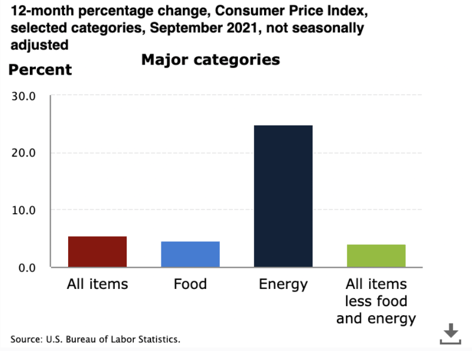

Ahhh! Look at that!

Ahhh! Look at that!

Inflation is measured in a variety of minimally sensical ways like price indexes. The Consumer Price Index (pictured above) includes energy as a small percentage of its overall total.

Now inflation is just a fancy way of saying either that the dollar is worth less or that things cost more (hint: those both mean the same thing). But how does this happen? Are there people with price guns just lying in wait to slap a new, pricier label on things as soon as they get the go ahead?

The simple and obvious answer is that prices of goods go up when the price of raw materials go up and the price of raw materials goes up in response to scarcity. Suppliers pass those costs on to the manufacturers and the manufacturers pass them on to consumers. Now, that makes sense with retail products, foodstuffs, and plenty of other consumable goods, but in the case of energy, that logic doesn’t really apply.

Now, energy prices are, technically, set by the price of ‘raw materials.’ In this case that’s natural gas. However, it does not cost a lot of money to pull natural gas out of the ground. Changes in energy prices are driven, bafflingly, by stock prices. So the stock price goes up, then the material prices go up, then the actual cost of the goods rises.

Commodities, for the most part, are priced in a way that doesn’t make a lot of sense. But as long as people keep paying those prices, they’re not likely to drop any time soon. For their part, businesses, influenced by those stock prices, look to make decisions that would benefit them in an inflationary environment and continue to perpetuate the cycle of high prices.

The reality is that, most likely, the only thing that’s going to bring these prices back down again is decreased consumption (i.e. reduced demand). As the saying goes “there’s no better cure for high prices than high prices.” At some point, these prices will cure themselves because consumers won’t be willing or able to pay them.

However, energy customers can combat these inflationary energy prices in a quicker and more direct way by building and investing in Solar Energy. The tyranny of the global commodity markets has led energy users, particularly corporate ones, to believe themselves confined to the current status quo. Watching the market and passively responding to it is not the only option available to energy consumers.

Community Solar and Connected Microgrid options give energy users the opportunity to invest in the future of energy while extricating themselves from the current monopoly. By plugging into a local solar farm (Community Solar) customers can earn solar credits that go toward lowering their energy bill while simultaneously decreasing their costs by partially divesting from the commodity market. Another exciting option in renewable energy advancement is the Connected Microgrid which allows corporate entities to install solar panels on their own property at no up-front cost (seriously!) and connect those panels with others in the area to create a partially self-contained energy system even more liberated from the whims of the grid.

Building solar and other renewable energy sources will reduce the demand on the market and drive down prices while empowering consumers with control over their energy production, consumption, and costs.

The energy monopoly’s biggest fear is that people will shine light on this reality and then convert that light into usable energy!

.jpg?width=352&name=Untitled%20design%20(79).jpg)